Dividend Policy and Dividends

Basic Policies for Allocation of Earnings

The dividend policy of the Tokyo Electron ("TEL") is to link dividend payments to business performance on an ongoing basis and maintain a payout ratio of around 50%*1 based on net income attributable to owners of parent but with an annual dividend per share of not less than 50 yen*2 to assure stable returns to our shareholders. Besides, TEL will review our dividend policy if TEL does not generate net income for two consecutive fiscal years.

TEL will effectively use internal capital reserves to raise corporate value through earnings growth and provide returns directly to shareholders by concentrating investment in high-growth areas and linking dividend payments to business performance and earnings. Besides, we will flexibly consider share buybacks as part of shareholder returns.

(Note1) Above are based on the latest shareholder returns policy FY2016 onward we announced in July 2015, while our previous dividend policy since FY2011 year-end dividend was performance-linked payout ratio of around 35%.

(Note2) The amount has been changed from 150 yen due to a stock split on April 1, 2023.

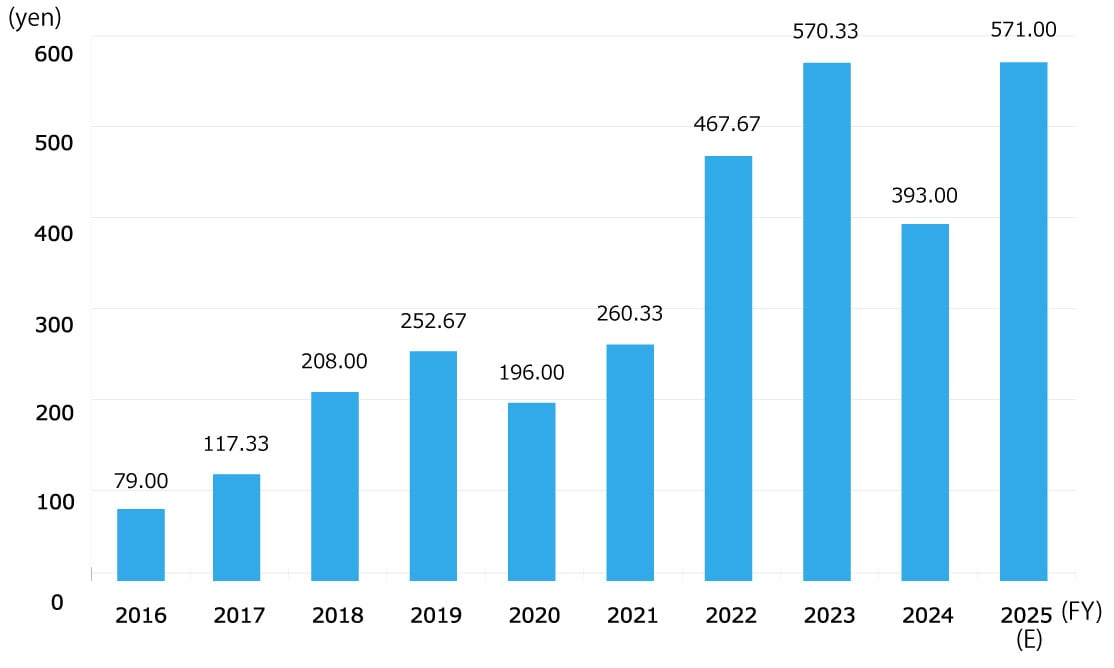

Cash Dividends per Share

Note: The Company implemented a 3-for-1 common stock split on April 1, 2023. “Cash Dividends per Share” from FY2015 to FY2023 are calculated on the assumption that stock split was implemented at the beginning of FY2015.

| Interim (yen) | Year-end (yen) | Total (yen) | |

|---|---|---|---|

| FY2024 | 148.00 | 219.00(E) | 367.00(E) |

| FY2023 | 285.67 | Ordinary Dividend: 218.00, Commemorative Dividend: 66.66 | 570.33 |

| FY2022 | 214.33 | 253.34 | 467.67 |

| FY2021 | 120.00 | 140.33 | 260.33 |

| FY2020 | 82.00 | 114.00 | 196.00 |

| FY2019 | 137.67 | 115.00 | 252.67 |

| FY2018 | 92.33 | 115.67 | 208.00 |

| FY2017 | 42.67 | 74.66 | 117.33 |

| FY2016 | 41.67 | 37.33 | 79.00 |

| FY2015 | Q1 Dividend: 3.33, Q2 Dividend: 10.00, Q3 Dividend: 11.67, Q4 Dividend: 22.67 | 47.67 | |